Usage

The Daily Sales Report shows the breakdown of sales information for your business day including day parts, report groups, and payment tenders.

Users

Managers, Owners, and Operators.

Report Header

![]()

All FOCUS reports list the name of the report and the business date period the report was run for. Underneath is a timestamp showing the date and time the report was generated. To the right-hand side, you will also see a page count so you can be sure you are getting all the data included in the report.

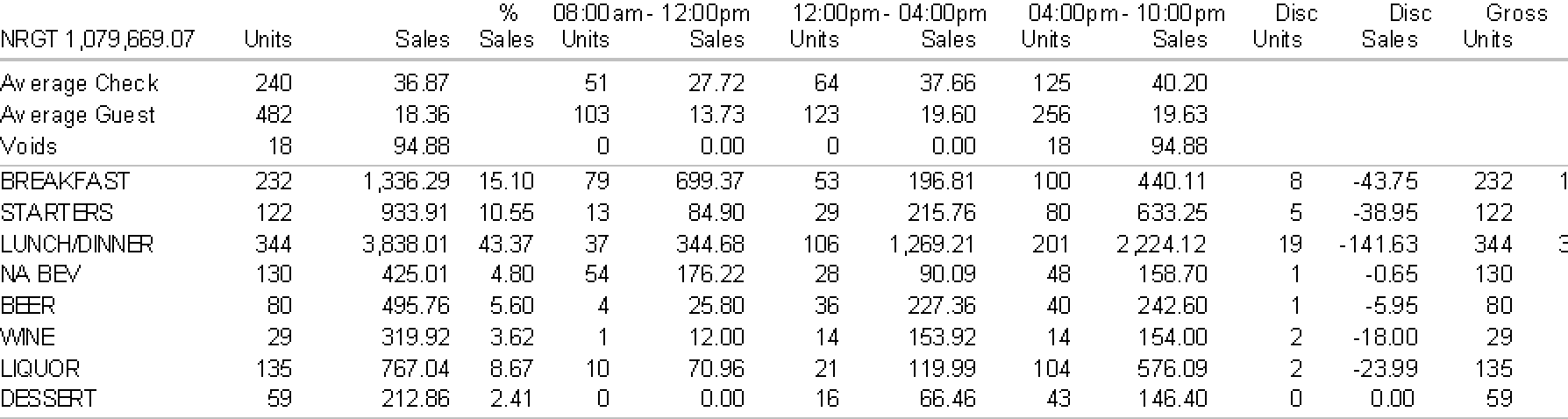

NRGT

Non-Resettable Grand Total. The NRGT equals the NRGT for the previous day plus the Subtotal on the Daily Report minus Item Discounts. The NRGT is not displayed if the report is run for multiple days (date range).

Dayparts

Dayparts can be defined on individual reports. This means you could have different daypart for different areas of your business. Up to 4 day-parts can be listed on each report. This does not affect the system-wide dayparts used for the nFocus Dashboard and above store reporting.

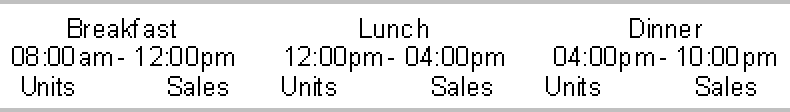

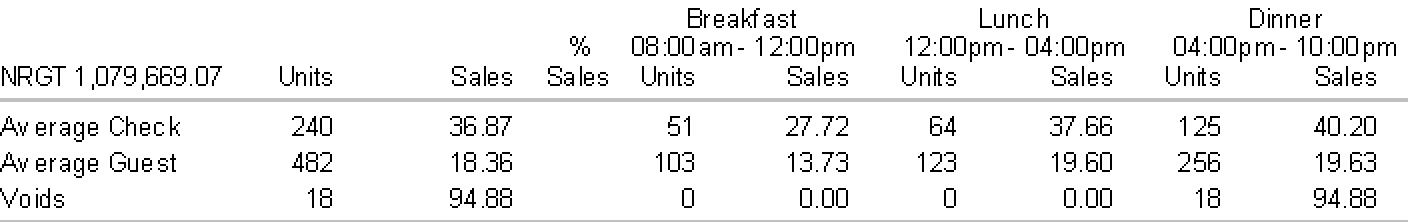

Averages & Voids

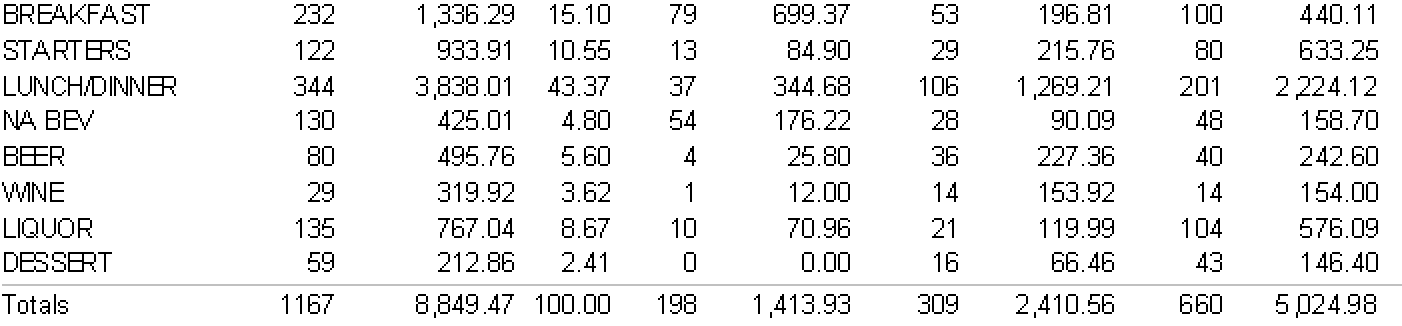

The first breakdown on the report shows Average Check, Average Guest, and Void information. Units are the quantity of each and sales is the dollar amount for each listing. The same information is given for the total time period the report was run for as well as a break down by dayparts.

Sales Report Groups

FOCUS calls its sales categories Report Groups. The next area of detail on the Daily Sales Report shows each Report Group with units and net sales for the entire period the report was run for and breakdowns for each daypart.

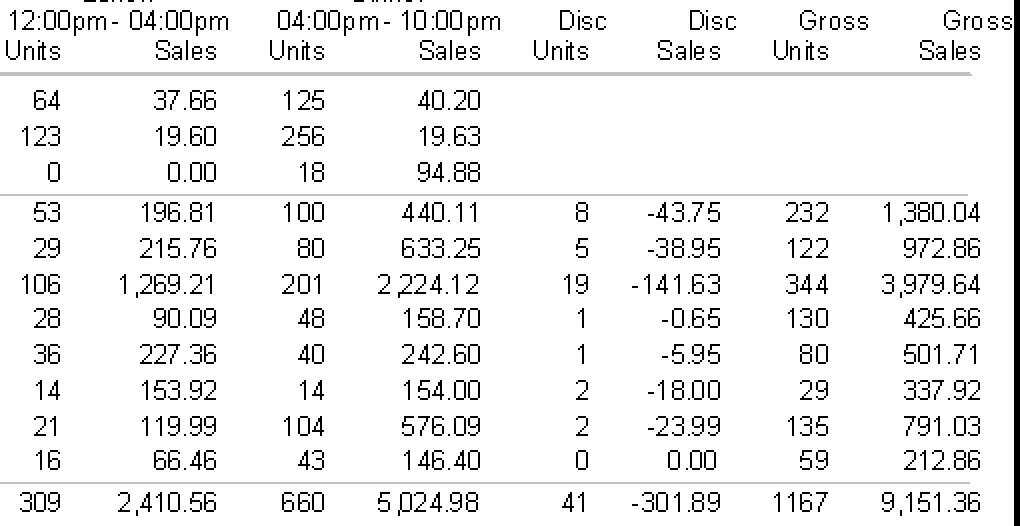

Item Level Discounts

Any discounts applied to specific menu items are shown to the right of each report group. Disc Units is the number of items and Disc Sales is the dollar amount discounted. These DO NOT include any discounts that were applied to the subtotal of the transaction.

Gross Units & Sales

To the very far right of each report group listing you will find the values for Gross Units and Gross Sales. Net Sales + Discounted Sales which are both listed to the left equal the Gross Sales.

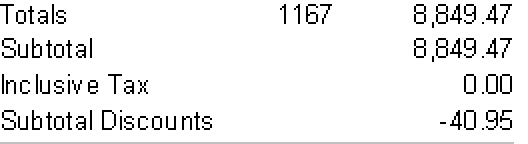

Totals & Subtotal

Totals show the total units and net sales amounts for the time period the report was run for and each daypart.

Order Type Charges if being used will be shown after the Totals section.

The Subtotal is Report Group Sales plus Order Type Charges.

Inclusive Tax lists the sum of all taxes included in the Net Sales.

Subtotal Discounts shows the sum of all applied discounts to check subtotals. Discount details are provided at the bottom of the report.

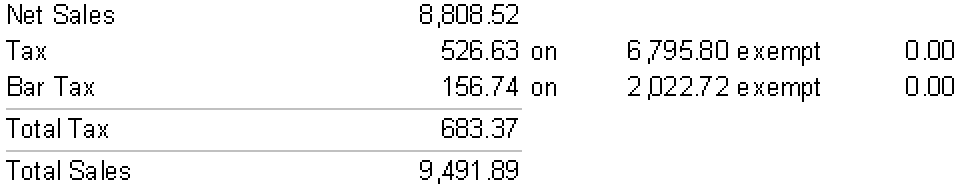

Net Sales & Taxes

Net Sales is the Report Group Sales plus Order Type Charges minus Inclusive Tax minus Subtotal Discounts.

Each Tax setup in FOCUS is individually listed along with the total collected. To the right of the total, you will see the dollar amount of sales the tax was calculated on.

If taxes are exempted from a transaction, the report will show exemptions listed to the far right of each tax AFTER the word 'exempt'.

Total Tax is the sum of all taxes collected.

Total Sales is the Net Sales plus Total Tax.

Non-Sale Transactions

All non-sale transactions are listed after the total sales. Non-sale transactions are any transactions that affect the revenue but are not sales of actual items.

Paid Outs record any monies taken from the business. Typically this would be cash that comes from petty cash or a drawer for paying a vendor.

Paid Ins reflects monies received by the business that were not sales. This can be used for deposits or install payments.

Gift Cards shows the total dollar amount of gift cards sold.

Refunds display the dollar amount of any monies given back to a guest.

Retained Tips is the total Tip Amount for all Non-Cash Payments. Note: This field is only displayed if the “Retain Tips” Option is enabled in Miscellaneous > General > Timekeeping >Retain Tips.

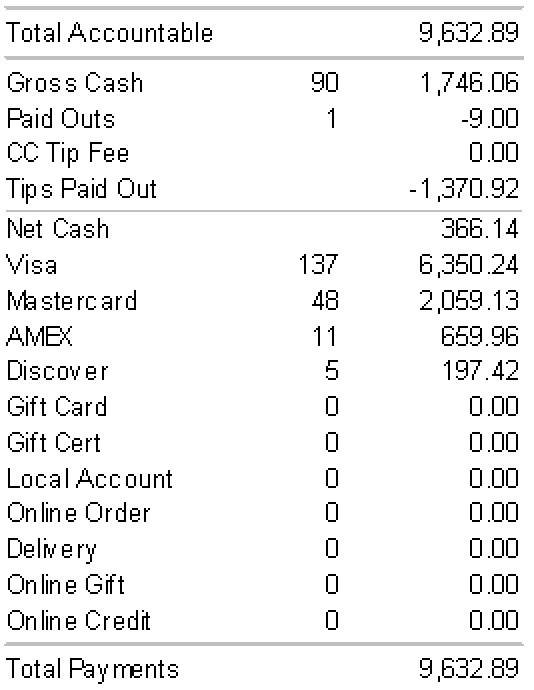

Total Accountable & Total Payments

Total Accountable is Total Sales minus Paid Outs plus Paid Ins plus Retained Tips plus CC Tip Fee plus Gift Cards.

Gross Cash is the total amount of cash monies collected by staff. This does not include cash tips or any change given to the customer.

Cash Paid Outs are listed again to show all factors the contribute to the calculation of the Net Cash.

CC Tip Fee shows the sum of tip fees being taken from employee tips. Note: It is not advised to set this up in the state of California. Please consult with your HR/Labor consultants.

Tips Paid Out is the total amount of charge tips being paid out to staff. Note: This field is only displayed if the Miscellaneous > General > Timekeeping >Retain Tips > Pay Out Tips option is selected.

Net Cash is the Gross Cash minus Paid Outs plus the CC Tip Fee minus Tips Paid Out minus Advances plus Retained Tips. You may hear us refer to this as the 'magic number' as it is the value you use to ensure a shift or business day balances.

Payments are broken down by each type configured in FOCUS and show the quantity applied and the dollar amount charged for each.

Below the payment breakdown, the sum of payments is displayed as Total Payments.

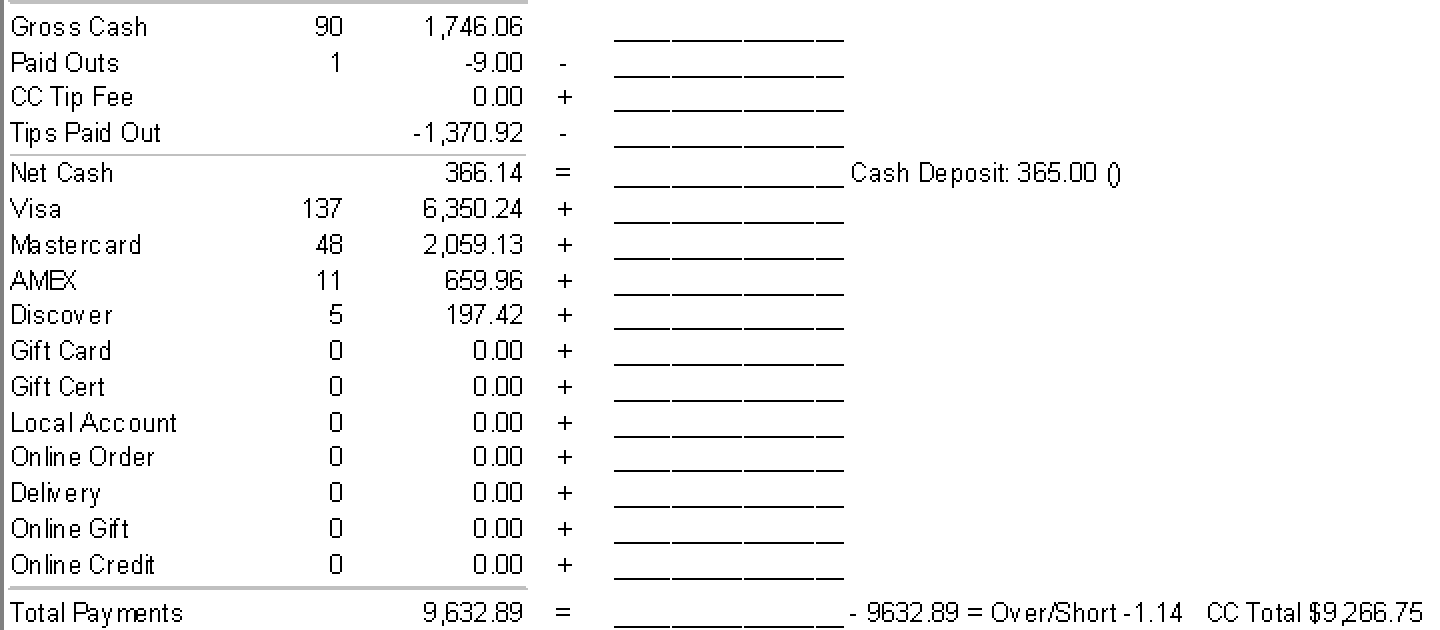

Deposit & Over/Short

Using the Deposit function in FOCUS you can record your Cash Deposit. This can be done multiple times a day. The sum of all Cash Deposits is then listed on the Daily Sales Report to the right of Net Cash. Additional notes inputted are displayed between the parathesis '()'.

The lines on the report can be used as a worksheet when printed to balance your business day.

Over/Short is the comparison of the Cash Deposit against the Net Cash.

CC Total is the combined total of all credit card payments.

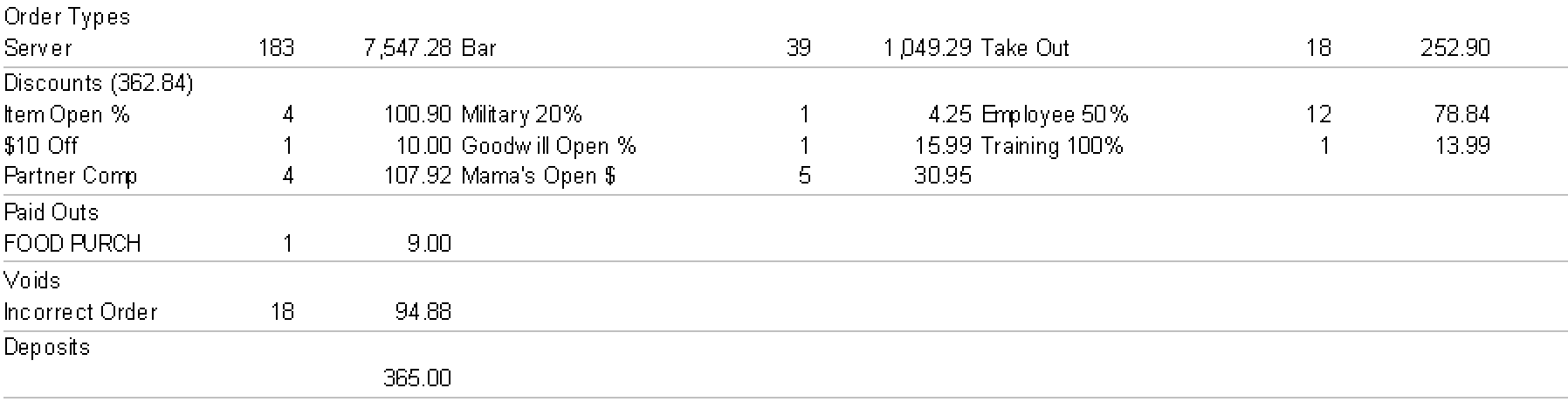

Additional Information

Order Types breaks down the number of checks and net sales by each Order Type.

Discounts display the total amount as well as a breakdown of each discount type with number and value of discounts applied.

Paid Outs gives a listed of each type of Paid Out performed along with the total dollar amounts.

Voids are broken out in more detail to show the individual void reasons.

Under Deposits the description and amounts are displayed for each Deposit if multiple have been entered for the day.

Comments

0 comments

Please sign in to leave a comment.